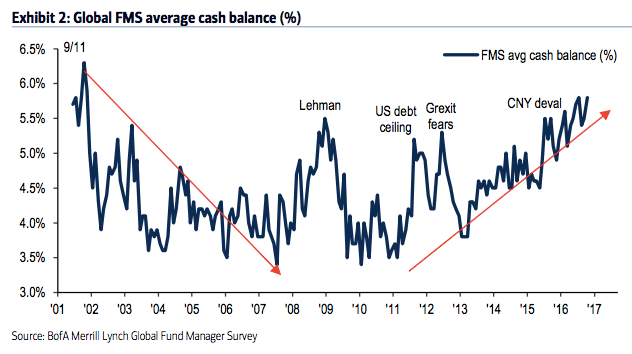

Summary: Throughout 2013, 2014 and early 2015, fund managers were heavily overweight equities and underweight cash and bonds. Those allocations have entirely flipped in 2016, with investors persistently shunning equities in exchange for holding cash.

Global equities are more than 15% higher than in February. A tailwind for this rally has been the bearish positioning of investors, with fund managers' cash in October rising to the highest level since 2001. Similarly, their equity allocations are now like those in February, mid-2010 and mid-2012, periods which were notable lows for equity prices during this bull market. Overall, fund managers' defensive positioning supports higher equity prices in the month(s) ahead.

Allocations to US equities had been near 8-year lows over the past year and half, during which the US outperformed most of the world. After rising for two months during the summer, allocations fell again to underweight in both September and October. Bearish sentiment remains a tailwind for US equities.

European equity markets, which had been the consensus overweight and also the world's worst performing region, are now underweighted relative to their long term mean. Investors are chasing the world's best performing region - emerging markets - which now have their highest overweight in 3 1/2 years. Emerging markets may rise further but note that the contrarian long trade is now over.

* * *

Among the various ways of measuring investor sentiment, the BAML survey of global fund managers is one of the better as the results reflect how managers are allocated in various asset classes. These managers oversee a combined $600b in assets.

The data should be viewed mostly from a contrarian perspective; that is, when equities fall in price, allocations to cash go higher and allocations to equities go lower as investors become bearish, setting up a buy signal. When prices rise, the opposite occurs, setting up a sell signal. We did a recap of this pattern in December 2014 (

post).

Let's review the highlights from the past month.

Cash: Fund managers' cash levels at the equity low in February were 5.6%. Despite the rise in global equities since then, cash levels are now higher, at 5.8%. This is equal to the high after the Brexit vote in July, higher than at any time during the 2008-09 bear market and at the highest since November 2001. Even November 2001, which wasn't a bear market low, saw equities rise nearly 10% in the following 2 months. High cash levels are supportive of further gains in equities in the month(s) ahead. Enlarge any image by clicking on it.